Hyperinflation and authoritarianism have constantly placed Venezuela in the sweet spot for a national cryptocurrency model. Whether for protection from its collapsing bolívar or to escape Nicolás Maduro’s strict regime, tech pundits are constantly touting the country as a best-case scenario for mainstream Bitcoin and digital asset adoption.

But according to a recent report from Chainalysis, Venezuela ranks fifth for total crypto value received in the Latin American region—and doesn’t even place in the top 20 worldwide. What’s going on?

The latest report installment, the 2023 Global Cryptocurrency Adoption Index, focused on Latin America. In it, Venezuela was in the spotlight for its “unique crypto utility,” highlighting the aforementioned political situation along with the nation’s well-known rampant inflation.

For Javier Bastardo, organizer of Satoshi in Venezuela, the largest grassroots Bitcoin group in the country and Bitfinex’s Bitcoin ambassador to Latin America, these numbers don’t really surprise him.

He pointed to a reality that Bitcoiners might not want to read: Venezuelans are more interested in the global reserve currency.

“People want access to dollars,” he told Decrypt, explaining that for years, the country “has been moving towards a de-facto dollarized economy internally.” Bastardo added that the narrative that hyperinflated countries will move to Bitcoin out of necessity is simply not true—in fact, he’s found people are more likely to use stablecoins before the top cryptocurrency.

That said, Bastardo pointed out that stablecoins are likely only used as an in-between, in the Venezuelan quest for “real” U.S. dollars.

His view resonated with that of Kevin Hernández, also known as Kevin Negocios, who is the founder of Venezuelan media outlet Criptodemia and author of “My First Days in Bitcoin.”

“Venezuelans don’t really want cryptocurrencies per se,” he told Decrypt, “but rather are looking for access to dollars.”

Hernández added that the actual economic uncertainty plaguing the country only puts the demand on products “with less friction,” such as Zinli, which grants easy access to dollars.

Chainlaysis pointed to a second factor that should drive the Venezuelan crypto economy: its authoritarian rule. “The crypto use case most unique to Venezuela is in how it can enable citizens to resist the oppression of the Maduro regime,” the report states, interviewing opposition leader Leopoldo López, who highly touted the technology’s use case in specific examples in the recent past.

Lopez spoke about using crypto to provide financial aid for 65,000 doctors during the COVID-19 pandemic, and how digital assets have served as a tool of resistance for the regime.

Both Bastardo and Hernández hinted that this was a “half truth.” They agreed that crypto is an alternative to an economy controlled with an iron fist (as Hernández told Decrypt), but its usage by the population is minor.

Once again, they said, “People are just looking for dollars.”

To emphasize the point, Bastardo mentioned that 92.5% of people stated in Chainalysis’ report that use centralized exchanges to access crypto. “It might be counterintuitive,” he told Decrypt, “but people just want something easy where they can then hop to dollars.”

The dizzying 92.5% is part of another startling finding in Chainalysis’ latest report: Latin America is dominated by centralized exchanges, with more than 60% of people using it versus a 48% average worldwide.

Jazmín Jorquera, Chief Operations Officer for Buda.com, an exchange that operates in Argentina, Chile, Colombia, and Peru isn’t really surprised by these numbers. “They offer an easy and simple experience, better liquidity, and just have an overall trust factor that can’t be overlooked,” she told Decrypt.

She pointed to general criminality in the continent, and that “there’s a risk to using platforms like peer-to-peer.” Jorquera added, “People don’t want to walk around with a bunch of cash.”

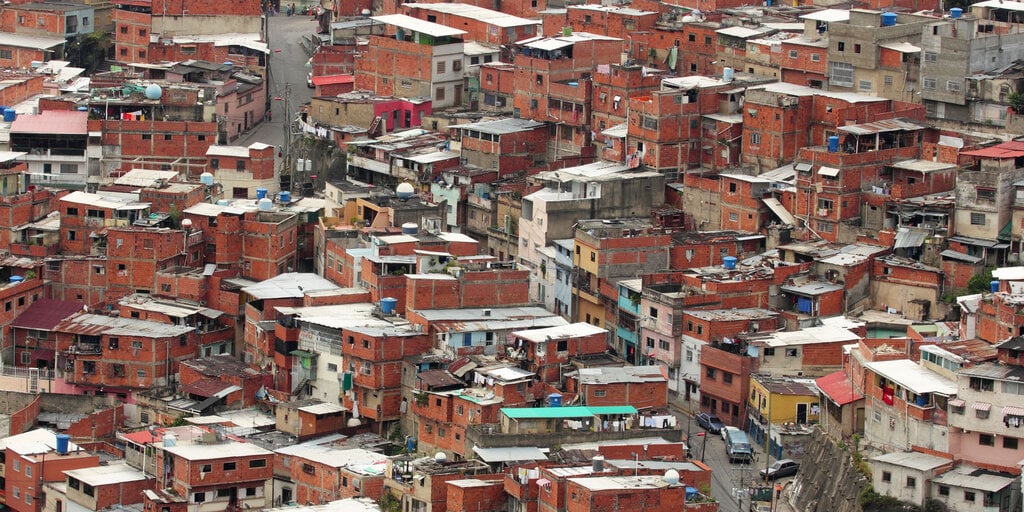

The latter points directly to Venezuela, a country that has seen citizens use wads of cash to pay for coffee.

Mexico is the one exception to the regional dominance of centralized exchanges, falling a couple of percentage points below the global average.

The founder of the Bitcoin Embassy Bar in Mexico City and community master for Fedi, Lorena Ortiz, explained that the nation has a booming tech scene, savvy youth, and many different platforms that service the country.

As for why Latin Americans overly use centralized exchanges, Ortiz told Decrypt it’s two-pronged. “The simplicity of it drives a lot of usage,” she said, and the second is crypto’s tax framework.

Since much of the industry is unregulated, “We don’t pay as much tax as other parts of the world,” she concluded. “That means most Latin Americans don’t really mind using these centralized platforms.”