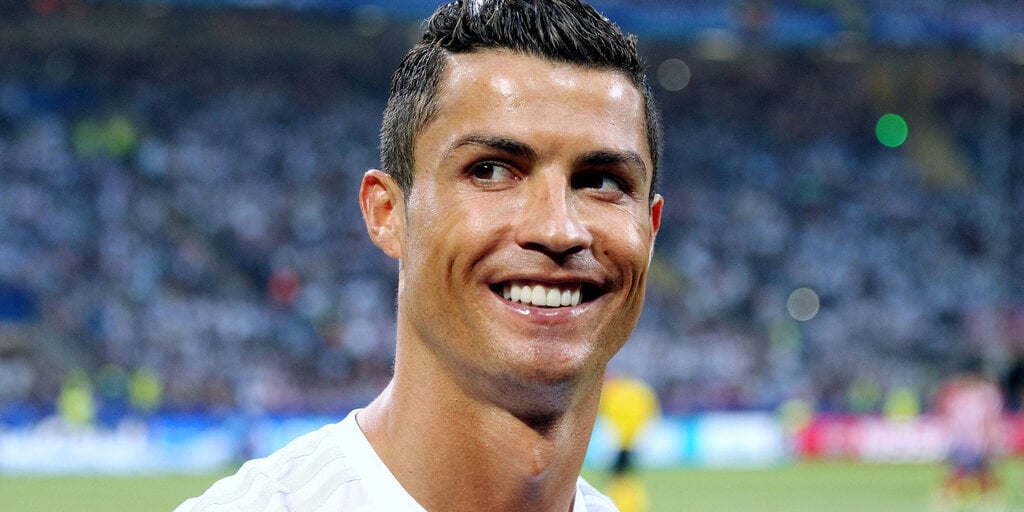

A class action lawsuit filed in Florida on Thursday seeks over $1 billion in damages from international soccer star Cristiano Ronaldo for his role in promoting the cryptocurrency exchange Binance.

The lawsuit alleges that Binance sold unregistered securities and operated illegally in the United States. It claims Ronaldo lent his celebrity to hype investments, driving traffic and investors to the platform.

“The binding law… across the country, regarding mass promotion of cryptocurrency and unregistered securities. was recently clarified and reversed,” wrote plaintiffs’ attorney Adam Moskowitz. He argued that under the new standards, “promoters like Cristiano Ronaldo, with a financial incentive for themselves or for the financial benefit of the securities issuer (Binance), can be held liable under securities laws for using the internet and social media for mass solicitations of cryptocurrency.”

The lawsuit cites Binance’s extensive alleged violations, including operating an unregistered exchange and clearing agency, failing to file suspicious activity reports, and not implementing anti-money laundering controls. Earlier in November, Binance paid over $4 billion in penalties related to these activities.

The plaintiffs meanwhile argue that Ronaldo benefited financially from driving traffic to Binance and should have known his promotions were potentially illegal. They claim that over 100 million Binance users were exposed to Ronaldo’s advertisements, including on TV and social media.

“Ronaldo’s promotions solicited or assisted Binance in soliciting investments in unregistered securities by encouraging his millions of followers, fans, and supporters to invest with the Binance platform,” the lawsuit states. “Given Mr. Ronaldo’s investment experience and vast resources to obtain outside advisors, he knew or should have known of potential concerns about Binance selling unregistered crypto securities and/or that he was aiding and abetting Binance’s fraud and/or conversion.”

Last November, Ronaldo released his first-ever NFT collection, dubbed “CR7,” in partnership with Binance ahead of the 2022 World Cup. The premium NFT series featured seven animated digital statues capturing seminal moments from Ronaldo’s illustrious career. Each scarce NFT depicted Ronaldo in an iconic pose, including his early years growing up in Portugal, breakout trick moves like his legendary stepover, and career-defining bicycle kick goals.

The digital collectibles had starting prices ranging from around $77 to $10,000. New Binance customers who created accounts with his promo code also received a “CR7 Mystery Box” containing one of two special NFTs. There were 777,777 NFTs of each type available.

Attorneys for the plaintiffs believe compensation is the only path to justice for victims.

“Investors have now lost more than $11 billion dollars and some exchanges such as FTX and Voyager have gone bankrupt, so this complaint is one of the victims’ only avenues to recoup any of those direct losses from these specific promoters,” wrote Moskowitz.

The liability faced by celebrities who dabbled in crypto promotions was starkly expressed by the Securities and Exchange Commission when it filed charges against NBA Hall of Famer Paul Pierce earlier this year.

“The law requires you to disclose to the public from whom and how much you are getting paid to promote investment in securities, and you can’t lie to investors when you tout a security,” SEC Chair Gary Gensler said at the time. “When celebrities endorse investment opportunities, including crypto asset securities, investors should be careful to research if the investments are right for them, and they should know why celebrities are making those endorsements.”

“The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion,” added Gurbir S. Grewal, Director of the SEC’s Division of Enforcement. “Investors are entitled to know whether a promotor of a security is unbiased.”

The SEC’s order declared that Pierce violated the anti-touting and antifraud provisions of the federal securities laws.

Editor’s note: This story was drafted with Decrypt AI from sources referenced in the text, and fact-checked by Ozawa.