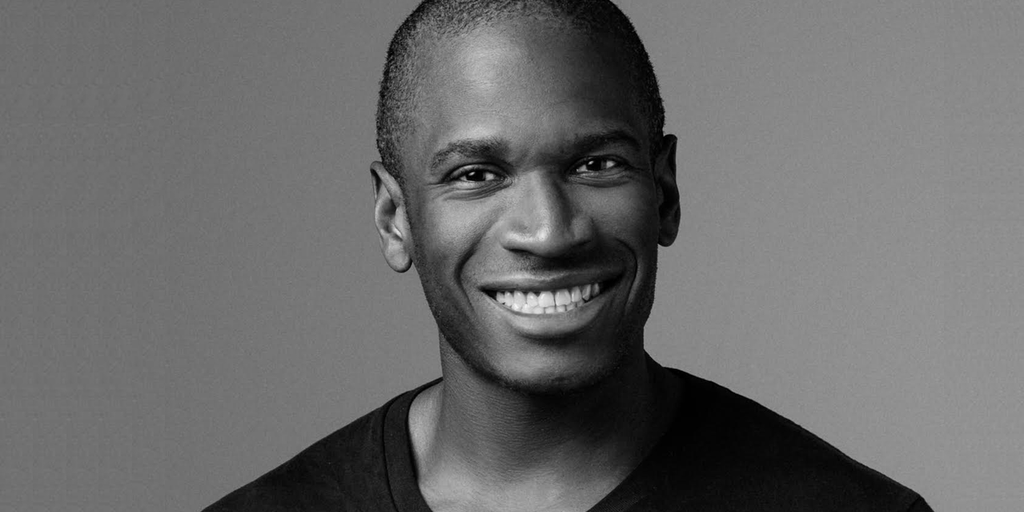

BitMEX co-founder Arthur Hayes believes the Federal Reserve will lose its quest to beat inflation, ultimately benefiting “risk assets of finite supply,” such as Bitcoin.

In a blog post published on Wednesday, the essayist argued that the Fed is sucking money from one area of the economy while injecting money into another.

As long as the Fed’s strategy to combat inflation remains “quixotic,” assets like Bitcoin will likely rise in the long run.

“Bitcoin has a finite supply, and therefore as the denominator of fiat toilet paper grows, so will Bitcoin’s value in fiat currency terms,” Hayes wrote. Aside from big tech and crypto, the ex-CEO believes nothing will yield a better return for investors besides parking their money at Fed and earning nearly 6% yield.

He went on to explain why the Fed’s tactics have been flawed.

Specifically, by continually raising its Reverse Repo Program (RRP) and Interest on Reserve Balances (IORB), the central bank is forced to pay out billions more per month to depositors, which counteracts the Fed’s effect on the money supply from quantitative tightening (QT; selling bonds on the open market).

“If the Fed believes that to kill inflation it must both raise interest rates and reduce the size of its balance sheet, then it is cutting its nose to spite its face,” wrote Hayes.

The central bank’s approach differs from Paul Volcker – a former central bank chairman credited with crushing inflation in the 1980s through hawkish monetary policy. As Hayes explained, while the Fed in the 1980s may have adjusted its policy rate, it did not micromanage RRP and IORB rates to match it.

“The only variable that changed from the Fed’s perspective was the size of its balance sheet,” said Hayes.

At present, the Fed is draining $80 billion per month from the market through QT, while injecting $22.53 billion into banks. Though this still appears “restrictive,” Hayes estimated that the rising interest expense on U.S. government debt is putting another $80 billion per month back into the economy. “I estimate that ~$23 billion in liquidity is net injected every month,” he said.

Eventually, Hayes said he expects the Fed to reverse course on QT as the U.S. Treasury becomes replete with alternative buyers of its debt, and grows desperate to avoid a cataclysmic default. That said, the market doesn’t seem to acknowledge this as imminent, and thus hasn’t moved its capital into Bitcoin – yet.

“We gotta go down to go up,” concluded Hayes. “I’m not going to fight the market, but just sit tight and accept my stimmies.”